Lead Organiser/s Asian Development Bank (ADB)

Co-organiser/s SGV & Co., Guy Michael Williams

Background

This session introduces participants to Nature Credits, an emerging market-based financing mechanism designed to channel private capital toward conservation, protection, and restoration efforts in critical wetland ecosystems along the EAAF. Focusing on RFI Sites in the Philippines, Bangladesh, and Thailand, the session provides a foundational understanding of the concept, its applications, and the various factors that determine project viability.

The core of this Side Event is a bespoke Nature Credits Card Game. This hands-on activity enables participants to simulate a simplified yet grounded project development lifecycle, helping them grasp the decisions inherent in building a credible and bankable project.

Participants will navigate crucial development steps, including assessment of site characteristics, selecting relevant ecological interventions (through the lens of Maintenance & Protection or Restoration), and optimizing the project’s Ecological Uplift—the quantified, verifiable nature-positive outcome that underpins the Nature Credit claim—with financial realities. The simulation requires the management of key foundational elements:

• Ecological Integrity: Participants must consider the current state and needs of their site in relation to available options for ecosystem-based interventions. Climate risks threaten the permanence of outcomes and necessitate thoughtful project design.

• Project Financing and Offtake: The participants aim to make their project bankable by establishing deals with credible, dependency-driven buyers and accessing appropriate sources of capital to de-risk their project profile.

Ultimately, participants must make their project bankable by unlocking sufficient demand from prospective buyers and securing adequate investment and risk mitigation instruments. The game highlights the need to balance project costs with potential financial inflows while maximizing measurable ecological uplift.

The session aims to equip participants with a clear understanding of the Nature Credits concept and the hypothetical project development lifecycle, underscoring the importance of both financial and ecological variables in assessing the feasibility of a project. By the end of the session, participants will have a high-level understanding of Nature Credits, appreciating their role in nature financing landscape and grasping the central balance between ecological feasibility and financial bankability throughout the project lifecycle.

Objectives

1. To equip participants with a clear understanding of the Nature Credits concept, as applied to RFI Priority Sites in the Philippines, Bangladesh, and Thailand.

2. To provide participants with an overview of the hypothetical project development lifecycle and key considerations within a simplified Nature Credits framework.

3. To underscore the importance of both financial and non-financial variables in assessing the viability of Nature Credit projects.

Expected Outcomes

At the end of the session, participants should:

1. Have acquired a high-level understanding of Nature Credits and the role that such a market mechanism can fulfill in driving finance towards critical restoration and maintenance activities in priority RFI sites.

2. Understand the ecological and financial considerations involved in project development and their impacts on viability throughout the project lifecycle (from inception and financing to issuance and delivery to buyers).

3. Gain an appreciation of the benefits of Nature Credit project activities and potential risks to their bankability, ecological feasibility, and demand-side marketability.

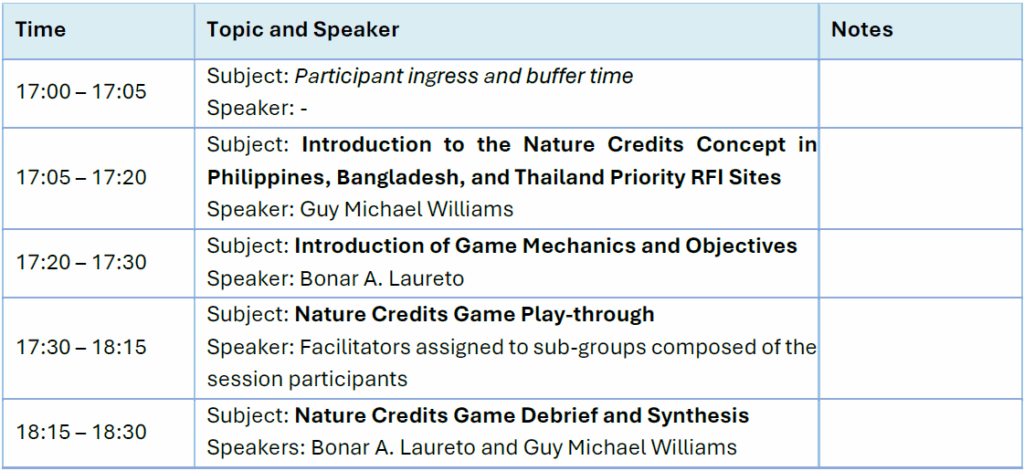

Tentative Programme